How to Import Christmas Decorations from China – Why Yiwu Is the Best Place for Xmas Products

Pair of snowy artificial Christmas trees decorated with pink and red ribbons, baubles and warm lights in front of a showroom window at Yiwu Christmas Decorations Wholesale Market.

Quick Jump to The Topic You Are Interesting in by Clicking Below Highlighted Heading:

- Why Source Christmas Decorations from China?

- Where to Buy: Yiwu and Other Sourcing Hubs

- When to Buy: Planning Your Seasonal Sourcing Timeline for Christmas Products

- Finding Reliable Christmas Product Suppliers and Vetting Them

- Trends and Innovations: Smart, Eco, and Customized Christmas Decor

- MOQ, Lead Times, and Production Cycles for Christmas Products: What to Expect

- Quality Control: Ensuring Your Christmas Goods Shine

- Shipping and Logistics: From Santa’s Workshop to Your Door

- Overcoming Common Challenges and Risks When Buying Christmas Products

- Final Useful Tips: Checklist for First-Time Christmas Decoration Buyers

Introduction:

Each winter holiday season, millions of homes around the world sparkle with tinsel, twinkling lights, and festive ornaments – and chances are, most of those Christmas decorations came from China. In fact, one small city in eastern China, Yiwu, produces an estimated 80% of the world’s Christmas merchandise. From plush Santa Claus toys to fiber-optic trees, China’s factories and wholesale markets supply global buyers with an incredible variety of holiday decor at competitive prices. For wholesalers, e-commerce sellers, and small business owners alike, sourcing Christmas decorations from China can be a huge advantage – if you know how to navigate the process.

In this comprehensive guide, we’ll walk you through everything you need to know about importing festive décor from China. We’ll cover when and where to buy, how to find reliable suppliers, current design trends, understanding production lead times and MOQs, quality control tips, and shipping logistics. You’ll also learn how to handle challenges like high freight costs or tariff uncertainties, and why Yiwu is known as “Santa’s real workshop” for the world. This guide is friendly and down-to-earth, so grab some eggnog (or Chinese milk tea!) and let’s unwrap the secrets to successful Christmas products sourcing from China.

Why Source Christmas Decorations from China?

Yiwu Christmas decorations textile shop featuring walls of Christmas cushions with Santa and reindeer designs, matching stockings and a central artificial tree, supplying soft furnishings for festive interiors.

Unbeatable Variety and Volume: China is the #1 global source for Christmas decorations, with tens of thousands of different products available. From shatterproof baubles and LED string lights to life-size inflatable snowmen, you can find virtually every kind of holiday decoration imaginable in Chinese markets. Yiwu alone offers 20,000+ distinct Christmas items each year, from basic tinsel garlands to high-end animatronic Santas. This vast selection means one-stop shopping – you can source everything in one go, saving time and shipping costs by consolidating orders.

Competitive Pricing: China’s manufacturing scale and efficiency translate to very affordable prices for holiday decor. Whether you need $0.05 tinsel strands or $50 illuminated wreaths, Chinese suppliers offer a range of price points far lower than many local wholesalers. For example, in Yiwu a simple Santa hat might wholesale for as little as ¥3.5 each (about half a US dollar) when bought in bulk! Even after adding shipping and import fees, your per-unit cost is typically much lower than sourcing domestically, giving you good margins for profit.

High Quality and Innovation: Price doesn’t mean skimping on quality. Chinese Christmas product makers have sharply improved materials and craftsmanship in recent years. Many factories follow international quality standards – using non-toxic paints that meet EU/US regulations, durable plastics like PE for trees instead of flimsy PVC, and even eco-friendly materials like wood and fabric for ornaments. Industry associations in Yiwu have developed quality standards for items like lights, hats, wreaths, etc., to ensure consistency. Suppliers also invest in innovation: think fiber-optic Christmas trees, Bluetooth-enabled string lights, and music-playing ornaments. As we’ll discuss later, “innovate or be left behind” is the mantra – so you’ll find plenty of new, exciting designs each season coming out of China’s factories.

Mass Production = Reliable Supply: China’s Christmas décor industry runs like a well-oiled machine. Many factories specialize in holiday goods and ramp up production on a massive scale. It’s said that “without Yiwu, Santa might lose his job”, because this single city’s factories and workshops support the Christmas dreams of billions. Large orders (think container-loads of trees or ornaments) are routine for Chinese suppliers – so volume is rarely an issue. If you need 100,000 glittery ornaments, a Yiwu factory can likely make that happen on schedule. The supply chain is also fully integrated, with local sources for raw materials (plastics, LEDs, fabrics), packaging producers, and experienced freight agents all in the ecosystem. This means fewer bottlenecks and dependable fulfillment for your orders, even at peak season.

Global Reach – Serving Every Market’s Taste: Chinese exporters don’t just cater to one country – they ship Christmas goods to over 100 countries every year. This global experience means Chinese suppliers understand diverse market preferences. Whether your customers are in the US, Europe, South America, Africa, or Southeast Asia, you’ll find products suited to their tastes. For instance, Yiwu manufacturers know that European buyers prefer natural, classic décor (green pine trees with subtle snow and gold bells), while South American buyers love vibrant colors and flashing lights for a party-like atmosphere. They’ve even designed Santa Claus figures in tropical shirts riding motorcycles to catch the eye of customers in warmer climates and new markets! This cultural adaptability is a huge advantage – sourcing Christmas items from China means you can find or custom-order products that resonate with your target market, wherever it is.

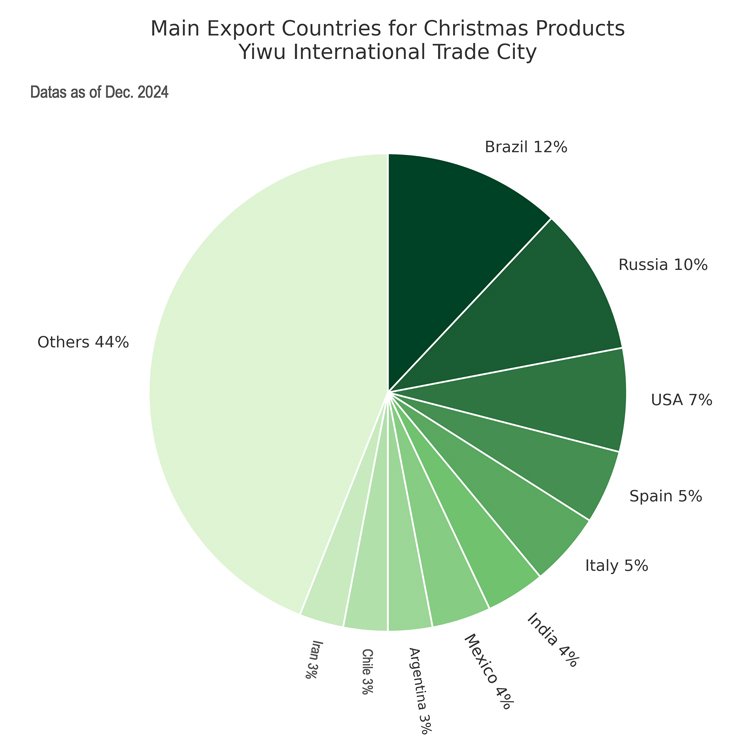

Main export countries for Christmas products from Yiwu International Trade City. Brazil, Russia and the United States lead, while “Others” still accounts for 44% of total exports.

Cost-Effective Shipping Options: As we’ll cover in detail later, China offers multiple shipping methods (sea freight, rail freight, air, even trucking routes) to get your goods delivered. Major ports like Shanghai, Ningbo, and Shenzhen handle enormous volumes efficiently, and new logistics channels (like the China-Europe railway and cross-border truck “land freight”) are opening up faster ways to ship to certain regions. With the right planning, you can optimize freight costs and transit times to meet your holiday deadlines without breaking the bank.

In short, China is the Christmas decoration capital of the world for good reason. By sourcing here, you tap into unparalleled selection, innovation, and manufacturing scale. Now let’s zoom in on the heart of it all – Yiwu – and other key sources for finding your perfect Christmas holiday products.

Where to Buy: Yiwu and Other Sourcing Hubs

In the busy Yiwu Christmas wholesale market, a group of foreign buyers negotiates prices and quantities for Christmas decorations with local suppliers while standing between aisles packed with Santa figures, celebration arts and crafts and sparkling holiday lights, highlighting Yiwu’s role as a global sourcing hub for Christmas products.

Storefront in Yiwu Christmas Decorations Wholesale Market displaying large plush Santa dolls, snowmen, reindeer and gnomes along the corridor, offering eye-catching décor for shops and malls.

Yiwu – “Santa’s Second Hometown”: If there’s one place you must know for Christmas sourcing, undoubtedly, it’s Yiwu. This city in Zhejiang province is famously called “the world’s Christmas products base”, and with good reason. Yiwu International Trade City (often just called Yiwu market or Futian Market) has an entire section dedicated to holiday decorations, with 600–800 permanent Christmas suppliers in one enormous wholesale complex. Strolling through the aisles, you’ll see floor-to-ceiling displays of ornaments, wreaths, trees, lights, costumes, and more, all available year-round (in Yiwu, it’s Christmas even in July!). In fact, a walk through the Christmas market in Yiwu is like visiting Santa’s workshop in real life – minus the elves and snow.

At Yiwu market, each vendor typically represents a factory or trading company. They showcase samples in their 9-square-meter booth, and you can place orders for bulk production or immediate shipment if stock is available. Prices are negotiable and generally quoted for MOQs (more on minimum order quantities later). The market’s sheer scale is mind-blowing – Yiwu International Trade City spans over 6 million square meters with 75,000+ booths for all kinds of products. The Christmas section alone offers over 20,000 types of holiday goods from low-cost trinkets (like $0.10 baubles) to high-end decorations (like $100 mechanical Santas). It’s common for a buyer to fill multiple shipping containers with assorted Christmas merchandise all sourced in a single Yiwu visit.

Insider tip: Many Yiwu shop owners speak basic English and are used to dealing with international buyers (the city typically hosts over 600,000 foreign buyers a year in normal times). Don’t be afraid to strike up a conversation, ask about product details, and request customizations. It’s common to exchange WeChat/WhatsApp contacts for follow-ups. If language is a barrier, hiring a local Yiwu agent or translator for the day is relatively inexpensive and can help smooth negotiations.

Other Regional Hubs: While Yiwu is the star, it’s not the only player in China’s Christmas decor scene. Depending on your product focus, you might also explore:

- Guangzhou & Shenzhen: In Guangdong province, these cities host large trade fairs and have wholesale markets where Christmas and seasonal decorations are featured, especially around Canton Fair time. Guangzhou’s annual Canton Fair (Phase 2, held in April and October) often includes holiday decorations in its Gifts section. Many exporters from across China (including Yiwu) showcase there. Shenzhen, being an electronics hub, is great if you’re sourcing high-tech holiday lights or smart decorations – a lot of LED string light factories operate in Shenzhen/Dongguan, offering the latest app-controlled or musical light sets.

- Shantou (Chenghai): Chenghai district in Shantou, Guangdong, is known as a toy production center. Some Christmas animatronics or novelty toys (dancing Santa robots, musical plush snowmen, etc.) come from toy factories here. If your focus is on toy-like decorations or children’s holiday items, Chenghai suppliers could be a good place.

- Zhejiang & Jiangsu factories: Outside of Yiwu city, the broader Zhejiang province (and neighboring Jiangsu) have many factories supporting Yiwu’s trade. For instance, Linhai and Dongyang (Zhejiang) are known for producing Christmas lights and artificial trees. In recent years, as Yiwu’s local costs rise, some manufacturing has partially shifted to nearby areas like Wenzhou, Taizhou, and even Jiangxi province, while Yiwu remains the sales and distribution hub. So, the shop you meet in Yiwu might have its factory an hour away in the suburbs or a neighboring town. Visiting those factories can be worthwhile for large orders or to inspect production.

- Online B2B Platforms: If travel isn’t feasible, online marketplaces like Alibaba.com, Global Sources, Made-in-China, and 1688.com (the Chinese-language Alibaba platform) are rich hunting grounds for Christmas suppliers. Alibaba’s international site has thousands of listings for “Christmas decoration” – you can filter by verified suppliers, see product photos, and initiate contact. Many Yiwu vendors are active on these platforms as well, posting their popular items online. While you miss the tactile experience of Yiwu’s market, online sourcing lets you compare many offers quickly. Be sure to use the platform’s safety features like Trade Assurance (Alibaba’s escrow service) and check supplier ratings. Tip: Look for suppliers with export experience to your region – if a factory has shipped to the EU or USA before, they’re likely familiar with necessary quality standards and regulations.

- Trade Shows: Beyond the Canton Fair, consider specialized trade shows: the Hong Kong Mega Show (Oct) often has seasonal goods exhibitors, and international trade fairs like Christmasworld in Frankfurt or the Toy Fairs sometimes feature Chinese holiday decoration manufacturers. Meeting suppliers at a trade show can give you more confidence and the ability to see samples. Many Chinese companies invest in booth displays that replicate their Yiwu showroom experience. Post-pandemic, even virtual expos and “cloud” trade shows are an option – Yiwu’s commerce bureau has offered “online exhibit” services where buyers can video-call to a showroom. It’s not quite the same as being there, but it’s a useful hybrid approach.

Balancing Perspective: Overall, Yiwu remains the go-to hub for most buyers because of its breadth and convenience (it’s literally nicknamed the “World Supermarket”). But it’s wise to keep a balanced sourcing strategy. Consider sourcing some specialized items directly from factories (especially if you need very custom products or extremely large volumes of one item), while using Yiwu or Alibaba for variety and smaller accessories. This way you leverage the strengths of each channel. And remember – many Yiwu vendors are factory-direct or closely tied to factories, so you often get factory pricing with the market’s one-stop selection.

Next, let’s talk timing – because when you order is just as critical as where it is.

When to Buy: Planning Your Seasonal Sourcing Timeline for Christmas Products

Colorful wall of Christmas wreaths and tinsel cone trees at a supplier booth in Yiwu Christmas Decorations Wholesale Market, China, showing mixed styles with berries, bows, glitter and metallic finishes for bulk holiday orders.

Timing is everything in the holiday business. You don’t want your Christmas stock arriving at New Year’s! Chinese suppliers operate on a cycle that aligns with both production lead times and the global shipping calendar. Planning ahead will save you stress and money. Here’s a general timeline to follow for sourcing Christmas decorations:

Seasonal Sourcing Timeline for Christmas Decorations

| Time of Year | Sourcing & Production Activities (China) | Tips for Buyers (Global) |

|---|---|---|

| January – February | Chinese factories slow down or close for Lunar New Year (dates vary late Jan/Feb). Minimal production during the holiday. Many factories design new products for next Christmas during this off-season. | Use this time for planning and research. Identify product trends, line up budgets, and shortlist suppliers online. Be mindful of the New Year shutdown – inquiries may only get responses after factories reopen (usually mid-Feb/end-Fed). |

| March – April | Production resumes at full speed. Peak sample development and order placement period. In normal years, many US/EU buyers would visit Yiwu or trade fairs in spring (e.g. Canton Fair in April) to place Christmas orders. Early orders start getting into the production queue. | Place orders as early as possible – especially for large orders or custom items. By end of Q1, try to finalize designs and confirm with suppliers. Early booking secures your spot before the rush. This is also a good time to order samples for evaluation, before mass production. |

| May – June | Orders from abroad are in full swing. Factories ramp up output; container bookings for ocean freight begin for early shipments. By May, Christmas exports are visibly increasing – e.g. May 2024 saw a 90% YoY jump as the season kicked in early. Some suppliers stop accepting new far-distance orders by late June if production slots are full. | Finalize orders by June for on-time delivery via sea. Ensure all artwork/packaging details are confirmed. It’s wise to book ocean freight space early (or work with a freight forwarder) as summer approaches – rates can spike and space gets tight. If you’re running behind, you may still order now, but be prepared for faster shipping modes or limited choices if factories are near capacity. |

| July – August | Peak export season. Chinese suppliers are incredibly busy fulfilling Christmas orders. Containers are leaving ports in huge numbers – July and August often see the highest export volumes for Christmas items. Yiwu’s market is abuzz with foreign buyers and inspectors. By late August, production for overseas orders winds down, as goods must depart to reach in time. | This is the last call for sea shipments to reach most Western markets by Oct/Nov. If you order now, use expedited production if available and expect to pay premium freight (or consider rail/truck for EU). Stay on top of QC – consider hiring a third-party inspection in August to check goods before they ship. Also, have a backup plan (like some air freight for urgent items) in case of delays. |

| September – October | Shipping cut-off for distant markets. By September, many Yiwu vendors stop accepting new orders from Europe or North America because production + standard shipping would not meet the Christmas deadline. Factories complete last batches and focus on domestic China orders or nearby Asian markets, which have later timelines. In October, the export season wraps up – October 31st is like “season end” for Christmas exports, and any remaining goods might go by air if absolutely needed. Meanwhile, domestic sales in China pick up in October/November (for the small but growing local Christmas celebrations). | If you still need inventory and it’s September, you’ll likely need to use air freight or find local wholesalers with existing stock. However, you can also switch focus to next year: Many experienced buyers start product development for the next Christmas as early as October of the current year. Gather feedback on this year’s products and communicate with suppliers about new designs or improvements. You might even visit Yiwu in October to see post-season clearance deals and preview some prototypes for next year – suppliers often welcome input while ideas are fresh. |

| November – December | Chinese suppliers catch their breath or turn to fulfilling last-minute domestic orders. Some factories may start maintenance or retooling once export rush is over. They also begin planning for trade shows or new catalogs for the next year. Yiwu shops in November might still have ready goods to sell (great for small immediate needs, if you’re nearby or want to air ship a few cartons). Overall, the Christmas industry in China winds down as the world enjoys the festive season. | This is selling season in your market! Focus on marketing and selling the products you sourced. Keep in touch with your supplier and provide sales feedback – they’ll appreciate knowing what’s selling well (helps them prepare for repeat orders). Also, evaluate your logistics: did your goods arrive on time? Any bottlenecks? Use these lessons to refine your plan for the next cycle. By December, you should already be thinking of next year’s lineup, so you can hit the ground running with suppliers come January. |

* if you are reviewing this comparison table via a mobile phone and the table doesn’t display completely, simply swipe the table to the right to see the rest.

As the timeline shows, the key is to start early. In recent years, buyers have been ordering earlier than ever – sometimes nearly a full year in advance for big orders. This trend was driven by unpredictabilities in shipping (more on the Red Sea crisis and logistics later) and a stronger demand rebound. For example, many European and American importers began securing Christmas 2024 stock in late 2023 itself. The earlier you plan, the more choices you’ll have: you can sample products leisurely, negotiate better prices before factories get too busy, and choose economical shipping.

Conversely, what if you’re late? If you discover in August that you need more holiday inventory, all isn’t lost – but be prepared for challenges. Many suppliers might be fully booked, so you’ll need to hunt for ready-made stock (some wholesalers keep a bit of inventory or can sell you overruns). Platforms like Alibaba might have “ready to ship” listings for generic ornaments that can dispatch quickly. You could also consider buying from distributors in your country as a stopgap, though margins will be lower. And if you must produce something in September, air freight or express courier could be the only way to receive it by December, which is costly (often negating profit). Thus, following the above timeline will significantly increase your success (and sanity!).

With the “when” in mind, let’s address “how” to ensure you’re working with the right supplier – the one that will deliver quality products on time.

Finding Reliable Christmas Product Suppliers and Vetting Them

Three foreign buyers stand with a Chinese sales assistant inside a small Yiwu Christmas decorations supplier shop, surrounded by bright white snowflakes, baubles, bows, bells, wreaths and garlands hanging densely from floor to ceiling.

One of the biggest concerns when sourcing overseas is: “How do I know if this supplier is trustworthy and capable?” In China’s Christmas decoration industry, you’ll encounter everything from large, well-run factories to tiny trading outfits. Doing due diligence upfront can save you headaches down the line. Here are practical steps to identify and verify reliable suppliers:

- Start with Reputable Platforms or References: If you’re using Alibaba or similar B2B sites, look for indicators like “Verified Supplier” badges, transaction history, and ratings. Alibaba’s Gold Supplier status (paid) is common, but Verified (where a third party has checked the company’s credentials) carries more weight. Check how long they’ve been active – a supplier making Christmas goods for 5+ years is likely more experienced. Read the company profile: do they claim to be a manufacturer or trading company? (Either can be fine, but manufacturers have direct control of production, while trading companies might offer more variety by collecting from many factories.) If you have access to industry contacts or referrals, ask if anyone has dealt with the supplier. Sometimes simply googling the company name plus “scam” or “review” can reveal red flags from other buyers.

- Evaluate Communication: Reach out with questions about the product – a reliable supplier will respond promptly and professionally. Take note of their English proficiency and willingness to provide details. Do they answer all your questions about materials, certifications, packaging? Good suppliers are usually eager to showcase their product knowledge and past export experience. If a contact is evasive or only gives one-word replies, that could be a sign of lack of expertise (or an overbusy salesperson). The tone and responsiveness early on often reflect how they’ll be during the order process.

- Request Product Samples: Always ask for samples of the Christmas decorations you plan to buy, especially from a new supplier. While you may have to pay sample fees and shipping, it’s worth seeing and feeling the actual product. Inspect the sample for build quality: Are the seams of a plush Santa well-sewn? Do the LED lights work without flicker? Is the glitter shedding everywhere (hopefully not, given new eco rules!)? If you require certain certifications (e.g. CE or UL certification for string lights, REACH compliance for materials, etc), ask for proof and test reports. A reliable supplier will readily share certificates or at least declare compliance. Pro tip: Also observe how well the sample is packed – if it arrives neatly and safely, that’s a good sign for how they’ll handle large shipments.

- Factory Audit (Virtual or In-Person): For a larger partnership, it can be wise to visit the factory or hire a third-party to conduct an audit. If you’re in Yiwu, you could travel to the factory site (many are close by in Zhejiang province). If not, you can arrange a video call tour – some suppliers will agree to walk around with a phone and show you the workshop, machines, and warehouse. Look for basic indicators of reliability: Is the facility organized? Do the workers seem to follow quality control steps? A factory making Christmas balls, for example, should have processes for coating, drying, quality inspection, and safe packaging. If the supplier is a trader and won’t disclose the factory, that’s not necessarily a deal-breaker (they could still be reliable coordinators), but then you’ll rely more on inspections of the goods themselves.

- Check Business Credentials: Chinese companies have business licenses – you can request a copy to see if the company name on the contract matches the actual entity that will produce or export your goods. On Alibaba, the company profile section often includes the license number and some verified details. Look for ISO certifications or membership in local industry associations (Yiwu has a Christmas Products Industry Association – members of such groups have a reputation to uphold). You can also ask for references of other clients, especially if they’ve supplied well-known importers or chain stores. Some manufacturers proudly list the retail brands they’ve worked with (e.g., if they made Christmas ornaments for a big-box retailer in the US, that hints at a certain standard).

- Small Test Order: If feasible, do a trial order with a smaller quantity first. This is a common approach – maybe you order a few cartons or a mixed batch of items to see how the supplier performs on a manageable scale. Did they ship on time? Were the products consistent with samples? How was the packaging quality? Treat it as a pilot run. If all goes well, you can confidently scale up your order. If not, you’ve limited your potential losses and can seek a different supplier before peak season.

- Use Secure Payment Terms: Payment method can indicate trust level too. Reputable suppliers often accept a deposit (e.g. 30%) and balance (70%) before shipping. This means you don’t pay in full until the goods are produced and shipped. Avoid any supplier that insists on 100% upfront payment for a large order – that’s not standard for bulk deals. Platforms like Alibaba offer Trade Assurance, where your payment is held escrow and you can dispute if goods aren’t as promised. For very large orders, sometimes Letter of Credit (L/C) payment is used, which heavily protects the buyer but is more complex. Choose a method that gives you confidence – even PayPal for samples or small orders can provide some buyer protection (though fees are higher). Reliable suppliers understand your caution and will usually accommodate reasonable terms.

- Watch for Too-Good-To-Be-True Offers: If you get a Christmas product quote that is significantly lower than others for the same item, be careful. It could be a sign of compromised quality or even a scam. The Christmas decor business runs on thin margins, so prices are usually pretty close. (e.g., if five suppliers quote ~$1.00 for a certain ornament and one quotes $0.30, there’s likely a catch.) Always consider the balance of cost and quality. It’s better to pay slightly more to a proven factory than to save a few cents and receive subpar goods that could tarnish your reputation with customers.

Overall, building a relationship with your supplier is key. The most reliable suppliers often turn into long-term partners. They’ll notify you of new designs, advise on shipping deadlines, and go the extra mile to keep you satisfied. For instance, many Yiwu shop owners have clients who return year after year – some overseas buyers have been sourcing from the same Yiwu family business for a decade. That kind of trust yields benefits like priority production slots and easier negotiations. So, invest time in choosing well, and treat your supplier honestly and respectfully; it goes both ways.

Now that you have a trustworthy supplier ready to work with, let’s look at what products are hot and how designs are evolving – because the Christmas decorations industry isn’t stuck in the past. It’s full of creativity and new trends that you should tap into.

Trends and Innovations: Smart, Eco, and Customized Christmas Decor

A festive selection of reindeer and Santa plush decorations displayed in the Yiwu Christmas wholesale center.

What’s new in the world of tinsel and twinkling lights? Plenty! Consumer tastes in Christmas decorations evolve over time, and Chinese manufacturers are quick to adapt – often even leading the trends with innovative products. Here are some of the top trends and design innovations to consider when sourcing:

- Smart & Interactive Decorations: The classic static ornaments now have high-tech cousins. Think Bluetooth-enabled Christmas tree lights that you control with a smartphone app, music-synced LED light shows, or figurines that dance or tell stories. In North America especially, there’s rising demand for interactive Christmas products. Factories in China have developed Santas that sing, plush reindeer that wiggle their ears, and pre-lit trees with dazzling light patterns you can program. One Yiwu company even patented a street lamp decoration that blows artificial snow out of the lamp top – creating a magical snowfall effect on your porch! With that U.S. patent in hand, they became the exclusive source for the product – a reminder that Chinese companies are innovating and protecting their IP too. When sourcing, ask suppliers about any new tech features. You might be surprised to find affordable options for what used to be premium gadgets. (And always ensure electronic items have necessary safety certifications for your market.)

- Eco-Friendly Materials: A green Christmas is a growing trend. Consumers (especially in Europe) are more conscious of sustainability and environmental impact. Chinese manufacturers have responded by offering decorations made of wood, fabric, paper, or recycled materials instead of all-plastic. You’ll see lovely wooden ornaments, metal wreath frames, burlap ribbons, and even biodegradable glitter. (In fact, traditional plastic glitter has been banned in some places like the EU starting at 2023, prompting a switch to alternatives.) Yiwu suppliers report that European buyers explicitly request eco-friendly products now. If your clientele values sustainability, explore the range of natural-look decorations: e.g., wooden snowflake pendants, cotton or wool felt Santa dolls, paper honeycomb baubles, etc. They often have a charming, rustic aesthetic – and you can market them as eco-conscious. Chinese factories have upgraded processes too, like using water-based or low-VOC paints and meeting stringent standards (some mention using EU REACH or Japan standard paints to meet high-end buyers’requirements).

- Higher Quality & Durable Decor: The days of flimsy, one-season-and-done decorations are fading. Buyers want items that last multiple seasons. A clear example is artificial Christmas trees. Early models were PVC with visibly fake branches that might not survive after rough handling. Now, many factories produce PE trees with molded tips that look very realistic, or use a mix of PE and PVC for fullness – these trees can command higher prices but offer longevity. Pre-lit trees with safe wiring and replaceable LEDs are another upgrade. Similarly, ornaments have gone upscale: instead of basic plastic balls, you can source shatter-resistant polycarbonate balls with intricate coatings, or even acrylic ornaments that sparkle like crystal. One Yiwu trend has been the rise of mid-to-high-end product lines: for example, a supplier might offer a simple Santa figurine for $2 but also a deluxe, motorized Santa in a sleigh for $50. As a buyer, decide where you sit in the market – you might find success importing a premium range that not everyone is offering. Chinese manufacturers will gladly show you both budget and premium options; in Yiwu shops, you’ll literally see price tags from a few cents up to hundreds of dollars, covering all market tiers. Quality sells, and end customers are often willing to pay more for decorations that look better built.

- Personalization & Custom Designs: Christmas is, at its heart, a holiday of warm family gatherings – and people love decor that feels unique. That’s driving a trend toward personalized and customized decorations. In retail, you see Christmas things like ornaments with family names, customizable tree toppers, or DIY craft kits. Chinese suppliers can cater to this by offering custom printing, engraving, or color variations for your orders. For example, you might request that a batch of ceramic ornaments has phrases in your local language, or have stockings embroidered with popular names. Many factories accept OEM (Original Equipment Manufacturer) orders where you provide the design or logo, and they produce it. If you have a creative idea (say, a Christmas-themed puzzle game or an exclusive ornament shape), don’t hesitate to ask if the supplier can develop it. Larger manufacturers have design teams and even 3D printing capabilities to prototype new products quickly. In Yiwu, it’s common for shops to put up signage like “Custom designs available” or to rotate sample displays every few days to show fresh ideas. They know buyers are hunting for that next hot item. In 2023-2024, an interesting note was the rise of DIY kits – products that let consumers craft or paint their own decorations (tapping into the personalization trend). If you serve a craft-loving customer base, you could source items like “paint-your-own ornament” sets or wreath-making kits from China, which adds value for the end user.

- Color & Style Trends: Each year, certain colors or motifs trend. Chinese suppliers keep an eye on global decor fashion. Recently, pastel colors and novel themes have been emerging in addition to traditional red, gold, and green. One supplier noted that where bold primary colors once dominated, now “we’re producing items in pastel tones and custom colors tailored to clients’ tastes”. For instance, you can find rose gold or blush pink ornaments, Nordic-style minimalist decorations, or “farmhouse” look pieces to match home decor trends. There’s also innovation in form factors: not just round baubles, but ornaments shaped like icicles, cupcakes, llamas, you name it. Theme sets (like a pack of ornaments all in a particular style, e.g., ocean-themed Christmas with seashell and starfish ornaments) are popular. When sourcing, ask suppliers what’s new or trending this year – they’ll often show you their latest collection. Many even proactively develop new lines months ahead. For example, even before Christmas 2024 had arrived, Yiwu factories were already designing products for Christmas 2025 by mid-year 2024. They gather feedback from buyers early (some clients start asking about next year’s designs as early as October of the current year) and iterate fast.

- Region-Specific Tailoring: As touched on earlier, different regions have different preferences, and Chinese suppliers have created products to match. Some interesting examples: Southeast Asian markets (like Philippines, Indonesia) often prefer smaller decorative items and wearables – e.g., reindeer antler headbands, Santa hair clips and costume accessories sell big there. South American buyers love vivid and novel designs – a factory might add extra sparkle, color-changing lights, or fun figurines knowing it’ll appeal in Brazil or Colombia. European buyers lean towards natural and simple elegance – lots of wooden ornaments, LED candles, plain warm-white string lights, etc., and suppliers cater to that with “minimalist chic” options. North America is somewhat in between, but the recent craze is for high-tech and novelty (as mentioned, interactive stuff) combined with classic motifs. If you operate in an emerging market that’s relatively new to Christmas (say parts of Africa or South Asia), you might find smaller MOQ products in Yiwu – like economical starter packs of decor – because suppliers see growth potential in these markets and are flexible to work with newer buyers. In fact, in 2024–2025, exports to Latin America, Southeast Asia, and even Russia have grown rapidly, becoming key growth areas for Yiwu’s Christmas trade. This means suppliers are really trying to win over those customers. As a buyer, you can use this to your advantage: don’t be shy about requesting a tweak (“Can you make this ornament set but with blue and silver only? That’s what my market likes”) – many factories will gladly accommodate if the order quantity is reasonable.

In summary, the product landscape is rich and ever-changing. Keep your assortments fresh by incorporating some of these trends each year. Perhaps carry a mix of tried-and-true basics (there will always be demand for a standard red Santa hat) and a percentage of new, buzz-worthy items (like laser-cut wooden ornaments or app-controlled fairy lights). This not only differentiates you from competitors but also positions your business as up-to-date and in tune with consumers’ wishes.

Now that we know what to source, let’s address an equally important aspect: the nitty-gritty of production – how much to order, how long it takes, and how to schedule everything smoothly.

MOQ, Lead Times, and Production Cycles for Christmas Products: What to Expect

A Yiwu Christmas ornament factory worker handcrafts glittering red and white snowflake baubles, preparing them for global holiday decoration orders.

When dealing with Chinese suppliers, you’ll often encounter the term MOQ (Minimum Order Quantity). This is the smallest quantity of a product a supplier is willing to sell, usually at the listed wholesale price. Understanding MOQs, typical lead times, and how the production cycle aligns with seasonal goods will help you plan your orders better.

Minimum Order Quantities (MOQ): MOQs can vary widely depending on the product and manufacturer. In Yiwu’s Christmas market, because there are so many small vendors, MOQs are often quite reasonable or flexible. For example, you might see a sign like “MOQ 200 pcs” for a certain ornament design – meaning you need to order at least 200 units of that design. For very inexpensive items (e.g., tiny glitter bows that cost $0.02 each), the MOQ might be higher, like 10,000 pieces, simply because it’s not worthwhile to process tiny orders. On the other hand, for larger, pricier items (say a motorized Christmas train set), a supplier might be willing to sell by the carton (maybe 10–20 sets). Don’t be afraid to negotiate MOQs if you need slightly less; many suppliers will bend if you’re close to their target or if they sense future business. Also, MOQs can sometimes be met by mixing designs. For instance, a factory might require 1,000 pieces as an MOQ for ornaments, but allow you to choose 4 different shapes/colors of 250 each to reach that total. Always clarify this: ask “Can I mix colors to reach the MOQ?” Most Yiwu vendors understand that buyers want variety, and as long as the production batch overall is large enough, they can accommodate.

For customized products, MOQs tend to be higher. If you want a custom logo printed or a unique color that isn’t in their standard lineup, the supplier might have to purchase specific materials or do a special production run. They’ll quote an MOQ accordingly (often because of minimum print runs or dye lots). For example, printing a design on a ceramic ornament might require at least 500 pieces to make it cost-effective, even if the plain ornament itself had a lower MOQ. Pro tip: If your volumes are smaller, consider sourcing semi-custom solutions – like using the supplier’s existing product but just changing the packaging or adding a small sticker logo. Many will do custom packaging (boxes, tags) at relatively low quantities, which can give your product a branded feel without needing a full custom manufacturing process.

Production Lead Times: Manufacturing Christmas decorations isn’t instant – there’s a lead time that can range from a couple of weeks to a couple of months, depending on the complexity and order size. Here are some reference timelines:

- Simple items (in stock or standard products): If a supplier has inventory on hand (sometimes Yiwu vendors pre-stock hot sellers), they can ship almost immediately. But assuming made-to-order standard items, many small decorations can be produced in 2–4 weeks for medium orders. For instance, an order of 5,000 plastic ornaments might take 2 weeks of production and 1 week for scheduling/packing.

- Complex or large items: Products like artificial trees (which involve multiple components and assembly) might need 4–6 weeks production, especially during peak season when the factory is juggling many orders. If you’re ordering a full container of various items, coordinating everything could also push it to 4–6 weeks.

- Customization adds time: If you’re prototyping something new, allow time for sampling (maybe 1–2 weeks for sample making) and then 4-8 weeks for production depending on complexity. Always build in a buffer for unforeseen delays (machine breakdowns, material delays, etc.).

- Peak season caution: Note that during the summer peak (June–Aug), lead times can lengthen. A job that’s normally for 2 weeks might take 4 weeks in July because the factory’s capacity is maxed out. Suppliers generally operate on a first-order, first-served basis; once your deposit is paid, you enter the queue. Another reason to order early – you’ll be nearer the front of the line and more likely to get prime manufacturing slots. By contrast, if you order very late and the factory does accept it, they might have to rush (overtime, expedited materials) which could increase the defect rate or cost.

Production Cycle and Key Milestones: Let’s outline a typical production cycle after you place an order:

- Order Confirmation & Deposit: You place the PO (purchase order) and usually pay a deposit (often 30%). The supplier confirms all details (item specs, packaging, shipping method, deadlines). This is the time to double-check the agreed delivery date – that means what time goods will be ready to ship.

- Materials Purchase: The factory buys raw materials needed – plastic pellets, LED components, fabric, etc. In Yiwu’s integrated cluster, many materials are available quickly, but if something is special (like a unique fabric print or a chip for a musical item), it could take a bit longer.

- Production & Assembly: The actual making of the product. E.g., for ornaments – molding the shape, then painting or electroplating, then drying, then adding caps and strings. Factories often produce in batches. If you have multiple items in your order, they might finish one completely then start the next, or work in parallel if different workshops handle each item.

- Quality Control Check: Good suppliers have in-house QC. They’ll inspect a sample of the batch for defects, make sure quantities are correct, etc. (I’ll talk more about your role in QC in the next section.)

- Packaging: Items are packed as per your requirements – polybags, inner boxes, master cartons. Check that the supplier uses sturdy export cartons and, if needed, moisture protection (especially for sea freight, as goods might be on water for weeks).

- Balance Payment & Shipping: Once goods are ready, you’ll be sent photos or a video, and the supplier will ask for the balance payment (if you didn’t opt for an inspection before paying, which you might). After payment, they will book the shipment. During peak export months, booking a vessel or container space itself can take 1-2 weeks, so the goods might sit in the warehouse for a bit until they’re picked up for port. If you’re consolidating shipments from multiple suppliers, things get more complicated – we’ll touch on logistics coordination soon.

Be aware of the Chinese calendar in planning production. Aside from the big Lunar New Year break (which can halt production for 2-4 weeks), there are other holidays like National Day week (first week of October) when factories and logistics pause. In the Christmas trade, October holiday isn’t as much of a problem (by then most orders are shipped or in final stages), but if you’re doing off-season orders or very late orders, a holiday can add a week’s delay. Communicate with your supplier about any upcoming holidays or power shutdowns (sometimes local governments ration electricity in summer which can slow factories – not common in Yiwu area recently, but has happened).

Flexibility for Reorders: Suppose you sell out of an item and want to reorder more for the same season. Can you do it? That depends on timing and MOQ. If you’re early enough (say July) and the item isn’t too much customization, many suppliers will gladly accept a reorder and prioritize it if possible (they love repeat business!). They might even have kept the production mold, making it faster. However, if you come back in October wanting more, most factories would have switched to other work (or be preparing for the next season’s development). One strategy for a first-timer: order a little less initially, test the market, but ensure your supplier knows you may reorder quickly. Some buyers arrange with the supplier to reserve capacity or raw materials for a potential reorder – essentially asking, “If this sells well, can you produce an extra X units on short notice?” If the supplier agrees, they might keep some materials in stock or not remove the assembly setup immediately. This kind of agreement works best once you have a good relationship.

Batch Shipping: Not all your goods need to ship at once. If you have a large order, you could do partial shipments – useful if some items finish earlier. For example, you ordered three styles of decorations; style A and B are done, but style C needs another 10 days. If you’re tight on time, you could ask the supplier to send A and B first (maybe via one container) and C later. This can incur extra freight cost (two shipments instead of one), but it can ensure at least part of your stock arrives earlier. Some big buyers stagger shipments intentionally to spread out arrival for easier distribution or to hedge against any one shipment being delayed. Work with your freight forwarder on the economics of this if needed.

In summary, plan your orders with realistic lead times and MOQs in mind. China’s Christmas factories are quite efficient (remember, they’re fulfilling billions of dollars worth of orders each year on a set schedule), but they’re not miracle workers – if you place an order on September 1st expecting it to arrive in New York by October 1st via sea, that’s just not feasible. Give them the time they request, and build in buffer for freight. They will hit agreed deadlines (most pride themselves on it), but if you constantly ask to expedite, mistakes can happen. It’s like asking Santa’s workshop to work double-overtime – they might, but an elf might drop a toy or two in the rush!

With a handle on production, let’s turn to ensuring those products meet your expectations – quality control is up next, something you should never skip when sourcing remotely.

Quality Control: Ensuring Your Christmas Goods Shine

Colorful ceramic Santa Claus, snowmen, Christmas trees and snow-covered houses neatly arranged on mint-green shelves at the Yiwu Christmas decoration wholesale market in China.

Nobody wants a nasty surprise of poor quality products after spending all that time and money. Quality control (QC) is essential when sourcing from China (or anywhere else). The good news is, with clear communication and perhaps third-party help, you can maintain great quality even from a distance. Here’s how to keep your Christmas stock up to standard:

Set Clear Quality Requirements Upfront: Right from the inquiry and sampling stage, communicate your expected quality level. This includes:

- Materials specifications: If you expect a certain material, say fire-resistant PVC for an artificial tree or lead-free paint on ornaments, mention it. Many Chinese holiday products already comply with international standards (for example, spray paints following EU standards to ensure no heavy-metal content), but you should explicitly state any regulatory requirements for your country.

- Workmanship details: For textiles like Santa costumes or hats, you might specify stitch count or fabric weight if it’s critical. For lights, you could require copper wire vs. aluminum wire (copper is more durable). These details depend on your product – essentially, think of any known quality issues in cheap versions of that item and address them. (E.g., cheap string lights sometimes have thin insulation – you might say “wiring must be double insulated” or comply with UL standard.)

- Sample as Quality Benchmark: Use the approved pre-production sample as the golden standard. Once you get a sample you’re happy with, tell the supplier to match this quality for mass production. Keep a reference for yourself and if possible, have the supplier sign off that mass goods will not deviate from it. Some buyers even do a “sealed sample” – both parties keep a copy of the signed sample for comparison later.

In-Line and Final Inspections: If you have a large order, you could do an in-line inspection – meaning check products while they are in production. This is less common for seasonal small goods unless you ordered a huge quantity or have a trusted agent on the ground. More typically, you’ll focus on final random inspection. Here you have options:

- Self Inspection (if you’re there): When visiting Yiwu or the factory, physically inspect a random selection of goods. If 10,000 units were made, check a dozen from different cartons in different stages of packing. Look for any obvious defects (paint scratches, loose parts, etc.).

- Hire Third-Party QC: There are professional inspection companies like SGS, Bureau Veritas, Intertek, Asiainspection (QIMA) and many smaller firms that operate in Yiwu and all over China. For a few hundred US dollars, they will go to the factory and perform an AQL inspection on your behalf. AQL (Acceptable Quality Level) is a standard process where they randomly sample (say 200 units out of 10,000) and count defects of different severities. You can set criteria: e.g., zero critical defects, minor defects below 4%. They’ll give you a detailed report with photos the same day or very soon. This is highly recommended for first orders or big orders. For example, they might catch that 5% of your snow globes have air bubbles or that some plush reindeer were sewn with the antlers backwards – things you can then insist be fixed or removed.

- Video/Photo Confirmation: At minimum, ask the supplier for photos or a video of the finished goods (and packaging) before shipment. Most suppliers will say Yes. This isn’t as thorough as an in-person check, but it might reveal glaring issues if, say, they produced the wrong color or a different item.

Common Quality Issues & How to Avoid Them:

- Color consistency: With large batches, sometimes color can vary (one batch of plastic might be a slightly different shade). Make sure the supplier knows color must be uniform. Provide Pantone color codes if critical (they can match them in production).

- Functionality of electronics: For light sets, etc, specify a testing procedure. Many factories already do 100% testing for electronics (like lighting them up for a few minutes). Ask that all lights be tested and bad bulbs replaced. If an item has moving parts or music, ensure each is checked. It’s reasonable to state “All units must be tested for functionality and only then they can be packed.”

- Durability of parts: For items that hang or attach, like an ornament’s cap or a wreath’s hanging hook, ensure they’re secure. These tend to be weak points. You can physically test a sample by tugging or dropping to see if it falls apart. Communicate any concerns (“The ornament caps should be glued as well as crimped, so they don’t pop off easily.”).

- Packaging strength: Insist on good packaging. Christmas decorations can be delicate. Corrugated boxes of appropriate strength, with dividers or bubble wrap for fragile items, are a must-have. If your goods are going by sea, mention “export-worthy packaging” – Chinese factories understand that means sturdy cartons, sealing, maybe desiccant packs to avoid moisture (particularly for items like metal that could rust or fabrics that could get moldy during shipping).

- Compliance and Safety: If your market requires it, perform required lab tests. For instance, electrical decorations in the US need UL certification – you should either source products that are already UL-listed or arrange testing for your batch. For the EU, CE marking is needed (often self-declared by the manufacturer, but you as importer must ensure it’s legit, especially for electronics or toys). If selling kids’ items like plush Santas or toy train sets, check if they meet relevant toy safety standards (like ASTM F963 in USA or EN71 in Europe). Reputable suppliers often have done these tests for other clients – ask for copies. If not, you can send a sample to a lab for testing (costly but important for compliance). Quality includes safety – the last thing you want is a fire hazard tree or lead-painted ornament.

Handling Defects: Inevitably, in any mass production there could be some defects. The goal is to minimize them and keep them within acceptable limits. But what if your inspection finds too many? Typically, you have the right to ask the supplier to rework or replace defective items. For example, if 8% of ornaments had paint smears and your acceptable limit was 2%, you can ask them to re-do that batch. This might cause a slight delay, but better than receiving subpar goods. A good supplier will take responsibility on that – Chinese business culture often seeks to maintain reputation, and they know that one bad shipment can lose a repeat customer. Many Yiwu vendors would rather fix the issue (even if they incur extra cost) than risk losing your future orders. You can also negotiate a discount or credit for minor issues if you’re willing to accept them (say you’re in a rush and a few minor blemishes won’t affect sales, you might get a small refund per unit).

Proactive Quality Improvement: Keep the communication going. After you receive the goods, let the supplier know how the quality was. If you found a few broken pieces or packaging could be better, they’d appreciate hearing it and can improve next time. Chinese manufacturers are typically keen to collaborate and continuously improve – especially if they see a long-term partnership. I’ve heard of suppliers who, unprompted, upgraded materials in subsequent orders because they found a better supplier or method, all to ensure the buyer’s end customers were happier. Building that rapport (and sometimes paying a bit more for higher grade materials) can lead to truly excellent quality over time.

In short, trust but verify. Many Chinese Christmas products are great quality (contrary to the old notion of “cheap Chinese goods”) – after all, even high-end brands source from China’s factories. But as the buyer, it’s on you to set the standards and check that they’re met. Do this, and you’ll be confidently delivering shiny, safe, and beautiful decorations to your customers every holiday season.

Now, with production and quality under control, let’s navigate getting these goods from China into your hands – time to talk shipping and logistics, including the best ways to get your holly jolly cargo across the globe.

Shipping and Logistics: From Santa’s Workshop to Your Door

Once your Christmas decorations are produced and packed, the next challenge is transporting them from China to your country efficiently. You have several shipping modes to choose from, each with its own cost, speed, and considerations. Let’s unwrap the options and some recent logistics insights:

Key Shipping Methods and Their Pros/Cons:

| Shipping Method | Typical Transit Time (China to US/EU) | Cost (per kg or cbm)** | Best For | Considerations |

|---|---|---|---|---|

| Sea Freight (Ocean) | 30–45 days (port-to-port for US; 25–35 days to EU via Suez). Add 1–2 weeks for port handling. | Lowest – e.g., $0.1–$0.3 per kg for full container (higher for LCL**). | Bulk shipments (large volumes, heavy goods). Most cost-effective for filling a container (FCL). | Long transit; need to plan well ahead. Rates can fluctuate (seasonally or due to crises). Ensure goods are well-packed for a long journey. Recent route disruptions (e.g. Red Sea/Suez issues) can add delays. |

| Rail Freight (China–Europe) | 15–25 days to Europe inland hubs via train. (Not applicable to US) | Moderate – cheaper than air, more than sea. Roughly $0.5–$0.8 per kg for LCL by train. | European importers needing faster-than-sea. Goods that can fill part of a container. | Only connects to Europe/Central Asia. Subject to rail network and border clearances. Reliable schedule generally, but capacity can be limited. Many Yiwu exporters began using rail to EU, especially during high ocean freight periods. |

| Truck Freight (“卡航” land trucking) | 10–20 days (China to Europe by road). ~1 week to Southeast Asia by road. | Moderate – similar to rail or slightly higher. | Regional routes (e.g. to Russia, Southeast Asia). Also used to supplement overloaded sea/air lanes. | China has initiated truck routes to Europe (via Central Asia/Russia) – fast and avoids port congestion. Good for time-sensitive goods when air is too costly. Ensure proper customs brokerage, as multiple borders involved. |

| Air Freight (Cargo) | 3–10 days (direct flight 1–3 days, plus export/import processing) | High – e.g., $5–$8+ per kg for general cargo. (Express courier even higher.) | Urgent or small shipments (samples, last-minute top-ups). High-value goods where speed outweighs cost. | Very fast, but costs can eat profits for bulky low-value items. Consider dimensional weight – decorations (bulky but light) incur charges by volume. It’s a Good backup if production is delayed or to meet a surprise surge in demand. |

** Note: LCL = Less than Container Load (shared container if you don’t have enough to fill one). Costs per unit are higher and there’s risk of slight delays waiting for consolidation. You can check this <FCL vs LCL: How to Choose the Right Ocean Freight> to get more details on LCL and FCL, how to choose.

As shown above, ocean freight is the workhorse for Christmas goods. Most importers ship by sea because decorations (e.g. trees, ornaments) can be quite bulky relative to their value, so the low cost of ocean per cubic meter is crucial. However, ocean freight requires that long lead time – you need to dispatch goods by late summer to get them in fall. It’s a balancing act: weigh the cost savings of sea versus the flexibility of faster methods.

Recent Shipping Challenges and Tips: The past few years have been quite eventful in global logistics. Here are some issues that came up and how experienced buyers navigated them:

- Red Sea Crisis (Suez Route Disruption): In late 2023 and into 2024, geopolitical tensions and conflict around the Red Sea/Suez corridor led many shipping lines to reroute vessels around the Cape of Good Hope (southern Africa). This extended transit times to Europe by ~2 weeks and caused freight rates to skyrocket (some routes saw 5x increases in container cost). European importers reacted by ordering earlier than usual (as we noted in timelines) to buffer the delays. Tip: Always stay informed on shipping news. If a major route is blocked or slow, consider alternate lanes – for example, some Yiwu exporters turned to the China-Europe railway or trucking to Russia/Europe to ensure delivery despite ocean troubles. This is a real-world example of why having that rail/truck option in your toolkit is useful.

- Container Shortages and Port Congestion: During the pandemic and even in 2021, we saw containers in the wrong places and ports (like LA/Long Beach or Ningbo) heavily congested. Yiwu’s exporters went through periods when getting a booking space on a boat was hard, no matter the price. Solution: book early through a reliable freight forwarder. The moment your production is scheduled, start discussing space with your forwarder. For large volumes, sometimes booking a full container in advance (even if it is not full, known as FCL) can be better than LCL in peak season – you have guaranteed space. Also, Yiwu companies began sending out shipments in smaller batches more frequently – for instance, shipping partial orders weekly instead of one big monthly shipment. This “don’t put all eggs in one basket” approach increased the chance that at least some containers would arrive on time. You can adopt a similar strategy if feasible: split your order into two shipments a couple weeks apart, so if one is delayed, the other might still make it.

- Freight Roller Coasters: Freight cost can swing. In mid-2024, shipping a 40’ container to Europe spiked to as high as $9,000 (from $2,000 earlier). These costs can eat into your margins or force price hikes. Some buyers negotiated cost-sharing with suppliers – interestingly, because shipping is typically paid by the buyer (FOB terms), foreign buyers started pressuring Yiwu sellers to give discounts to offset part of freight increase. One vendor complained she was only making ¥0.01 profit on a ¥0.40 Santa hat after granting discounts due to freight hikes. While you can’t always get a supplier to cut price, you might discuss terms like splitting shipping or delaying certain less urgent items to a cheaper season. In general, factor in a cushion for freight in your product costing these days. And be agile – if one route is too expensive, see if another is workable (e.g., sometimes shipping to a different port or using rail to a landlocked country then trucking can bypass a bottleneck and save cost).

- Customs and Tariffs: If you’re importing to the US, be aware of the Section 301 tariffs that have been in place on many Chinese goods. Christmas decorations can fall under various HS codes – some might carry an extra 7.5% or 25% tariff if not exempt. Check your item’s classification. For example, Christmas ornaments (not electric) are often under HS 9505.10, which in the US is duty-free traditionally (as festive articles) – but verify if Section 301 adds anything. Christmas lights could fall under a different category that had tariffs. Plan for these costs in pricing and explore if any duty-saving strategies exist (like first importing to a country like Mexico or Canada then to US might not avoid tariffs unless substantially transformed, so be careful with such schemes). Some North American buyers have indeed tried routing via other countries to mitigate trade war tariffs, but that’s legally risky unless you actually change the product’s country of origin ( we have a detailed blog on <Certificate of Origin>, you can take a look on that). A more straightforward approach is to negotiate pricing knowing the tariff impact or try to source certain items from tariff-exempt countries (though for Christmas decorations, China really dominates).

- Insurance: Always insure your shipments. Marine insurance is relatively cheap (maybe 0.3–0.5% of cargo value) and covers losses or damage at sea. With so much volume and some unpredictable events (remember the Ever Given ship that got stuck in Suez in 2021?), insurance ensures you’re financially protected if the worst happens (lost container, water damage, etc.). Also ensure your freight forwarder handles proper documentation – missing paperwork can cause customs delays. Christmas goods are generally not restricted items, but if anything contains electronics or batteries (like music boxes with button-cell batteries), ensure compliance with shipping regulations for those.

Working with Freight Forwarders: If you’re not experienced with logistics, partner with a good freight forwarder. Yiwu has many international logistics companies that handle consolidation, customs clearance, and delivery to your door. They can advise the best route: for example, Yiwu has direct connections to the Ningbo and Shanghai ports and even runs “Yiwu–Xinjiang–Europe” trains (YiXinOu) as a service. A forwarder might tell you, “Your goods are light but bulky; maybe ship by volume – consider LCL sea” or “Time is short to Latin America, maybe we send partial by air and rest by sea.” They earn their fee by providing these choices. Get quotes for different methods. Often a combination can work: e.g., fast-boat services (some shipping lines have fast service), or sea + truck/rail for landlocked destinations.

After Arrival – Import Clearance: Don’t forget the timeline for customs clearance at your destination and inland transport to your warehouse. In peak season, US ports can have backlogs (though it’s improved). Plan a week or two for clearance and trucking. Pay attention to any import licenses or regulations: Some countries have specific rules for holiday items (for instance, electrical standards or even quotas, though not common for decor). Make sure to file any necessary import declarations (your customs broker will do this). And schedule final delivery to your warehouse.

In summary, start logistics planning early – ideally while production is ongoing. Decide the shipping mode based on your required arrival date and budget. And be flexible to world events: as 2020-2024 showed us, things like pandemics, wars, and canal blockages can and do happen. If you have a cushion (both time and financial), you can adjust. Many global buyers who source from Yiwu China have learned to diversify logistics: some stock is sent early by sea, some buffer stock kept nearer market, etc. You’ll develop a feel for it after a season or two.

Alright, with goods safely on their way, let’s address a few remaining challenges and considerations, then wrap up with a handy checklist. (We’re almost at the end of our Christmas sourcing journey)

Overcoming Common Challenges and Risks When Buying Christmas Products

Sourcing from China can be extremely rewarding, but it’s not without its pitfalls. We’ve touched on many specifics above; now let’s summarize a few broad challenges you might face and strategies to handle them:

- Tariff and Trade Policy Risks: As mentioned, sudden changes in import duties or trade policies can affect profitability. Stay informed on trade news for your target market. If you sell in the U.S., monitor developments on tariffs on Chinese goods. Same for any anti-dumping duties (though none specifically on Christmas items as of now). You can mitigate some risk by diversifying sourcing (e.g., if a tariff hit artificial trees from China, perhaps import some from Vietnam or Mexico if possible – although those supply chains are small relative to China). Also, factor a buffer in pricing to absorb some duty if you must. Some sellers choose to warehouse goods in a free trade zone and only import as needed, hoping tariffs may change. For example, keeping inventory in a bonded warehouse or logistics hub in Hong Kong or Singapore gives flexibility – you haven’t paid duties until you move it into, say, the EU, and if a tariff is removed, you saved money. However, that approach has its own costs. Generally, being nimble and having honest conversations with suppliers is key; during the US-China trade tensions, some Chinese suppliers offered slight price reductions or alternate product codes to help (e.g., classifying an item under a non-tariff code if legitimately applicable).

- Communication and Cultural Differences: Working across languages and cultures can lead to misunderstandings. Always double-confirm details in writing. Chinese suppliers may say “yes” to requests to be polite or accommodating, even if they don’t fully understand – encourage them to ask questions. Use simple, clear English (or Chinese if you have that skill or a translator) for specifications. For example, instead of “The Santa outfit quality should be top-notch,” say “Santa coat fabric must be 100% polyester fleece, 250 GSM weight, no thinner. Sample I approved is the standard.” The more concrete, the better understanding. Culturally, note that Chinese businesses value relationships (“guanxi”). A little friendship goes a long way. Wishing them happy holidays (Chinese New Year especially) or asking how they’re doing can strengthen your partnership beyond just transactions. That means when issues arise, they’re more willing to work with you to find a solution.

- Payment Scams or Fraud: While most suppliers are legitimate, always be vigilant with payments. Never send money to a personal account or a different company name than your contract without very good reason. A common scam is someone hacking email communications and telling you the bank account changed. Always verify bank details via a secondary channel (e.g., call the supplier or use their verified Alibaba account). Using platforms or letters of credit reduces this risk. Also, split your payments – deposit and then balance – so you don’t pay all upfront. If a supplier pressures full payment upfront for a big order, that’s a red flag.

- Intellectual Property (IP) and Exclusivity: If you develop a unique design with a supplier, ensure you have an agreement about it. Otherwise, you might find your custom ornament being sold to other buyers. Chinese suppliers may assume if it’s not formally patented or protected, they can sell it freely. If exclusivity is important, include it in your contract (even if hard to enforce, it sets an expectation). Some buyers arrange that the factory won’t produce the specific branded version for anyone else. If you have a trademark or brand logo, register it in your country (and even consider registering in China if you scale up, to prevent someone else doing so). Generally, for most standard Christmas goods, IP isn’t a big issue – designs are often generic or licensed from elsewhere. But if you have a novel idea, protect it.

- Currency Fluctuations: The costs we discussed are often in USD, and many Chinese suppliers quote in USD (RMB in Yiwu’s Suppliers). But the Chinese Yuan (RMB) can fluctuate against USD/EUR. Most buyers pay in USD, so this risk is more on the supplier’s side (and they sometimes pad quotes to cover currency swings). But if you’re dealing in another currency or the exchange rate moves a lot between your deposit and final payment, it could slightly affect things. Some importers hedge by buying currency forward or just by paying quickly to lock rates. It’s not usually a huge factor for short-term deals, but worth noting.

- Environmental and Social Compliance: Increasingly, buyers (and their customers) care about ethical sourcing. China’s factories vary in labor conditions. While Christmas decor isn’t typically associated with severe labor issues like some industries, you might still want assurance that no unethical practices occur (e.g., no child labor, reasonable working hours especially during peak). Some large companies require supplier audits for social compliance. If this is important to you or your customers, you can opt for amfori BSCI audits or similar certifications from your suppliers. Some Yiwu factories have these, especially those supplying European retailers. There’s a cost to this, but it can be a selling point that your products are made responsibly. Additionally, there’s an environmental aspect – e.g., use of plastics, glitter microplastics, etc., which we responded to by trending toward eco-friendly materials. Being ahead on that trend not only attracts eco-conscious customers but also preempts any regulatory changes (like the glitter ban example – those who adapted early faced no disruption when the ban hit).

- Market Regulations (Beyond Import): Once goods arrive, ensure you comply with any local market regulations for selling. For instance, in the EU, certain Christmas lights must have proper CE marking and perhaps energy efficiency labeling. Or any toy-like item might need language-specific warnings. As the importer, those responsibilities fall on you. Plan for time to label products or their packaging if needed (some suppliers will print custom labels for you – use that service so it’s done in China). If selling via Amazon or retail chains, check their requirements too (Amazon might need ASTM test proof for kids’ products, etc.). Doing this homework avoids last-minute scrambling when your goods are at port or warehouse.

- The “Next Year” Problem: If something goes wrong and you miss the Christmas sales window, it’s not like other products where you can sell year-round. Seasonal merchandise has a shelf life. Missing it can mean holding inventory for a year (tying up money and storage space). So all the above planning and risk mitigation funnels into making sure you hit the holiday season on time. Always have that date circled in red on your calendar and work backwards with healthy margins for each step (production, shipping, customs). As a backup, identify local wholesalers who could possibly supply you last-minute if needed, so you aren’t left empty-handed during peak season. It’s not ideal, but a contingency plan is better than losing the season entirely.

Through all these challenges, a recurring theme is communication and preparation. Most pitfalls can be avoided with some foresight and by building a solid partnership with your suppliers and logistics providers. Thousands of global buyers successfully navigate these waters each year – and with this guide, you’re well equipped to join their ranks!

Finally, to tie everything together in a neat bow, let’s conclude with a handy checklist – a step-by-step summary for first-time buyers embarking on their China Christmas sourcing adventure.

Good Tips: Checklist for First-Time Christmas Decoration Buyers

Entrance of a Yiwu Christmas decorations wholesale shop featuring tall plush snowmen, reindeer, teddy bears and gnome dolls with hanging textile wall décor.

Sourcing Christmas decorations from China can seem complex, but with the right approach it can be extremely fruitful (and even fun – who wouldn’t enjoy shopping for festive goodies?). To ensure you cover all bases, use this practical checklist as you plan and execute your sourcing:

✓ Research and Planning: Define your product range and target market needs. Browse platforms like Alibaba for product ideas, note typical MOQs and prices. Keep an eye on current trends (e.g., eco-friendly materials, on-trend color palettes) so you can choose stock that will sell. Make a rough timeline by count backwards from when you need inventory in hand (considering your sales start date before Christmas).

✓ Budgeting: Calculate your landed cost per item (product price + shipping + import duty/tariffs + inland delivery). Ensure margins are healthy after all fees. Remember to budget for sample costs, inspection fees, and maybe a contingency for higher freight. If tariffs apply in your country, factor those in and classify products correctly to avoid surprises.

✓ Supplier Sourcing: Shortlist suppliers through reputable channels:

- Check Yiwu market directories or agents if visiting in person.

- Use Alibaba/Global Sources etc., filtering for Gold/Verified suppliers and those with good ratings.

- Attend virtual or physical trade fairs if possible (Canton Fair, etc.).

- For each potential suppliers, verify their profile, product range, and export history. Prefer suppliers who specialize in Christmas decor – they’ll have the right experience and product focus.

✓ Initial Contact: Send inquiries with clear product specifications and quantity. To see communication quality. Ask for photos of their showroom or factory to get a feel. Seek references or which countries they export to (e.g., if they regularly export to the US or EU, that’s a plus). Narrow down to 1-3 suppliers per product that seem most trustworthy and competitive.

✓ Sampling: Order samples of key items from your chosen supplier(s). Inspect the samples carefully upon arrival:

- Does the quality meet your expectations?

- Test any functionality (lights, moving parts) and durability (drop test an ornament, tug a wreath’s decorations).

- Check packaging if provided.

Provide feedback to the supplier and see how they respond – a good supplier will be open to minor adjustments or clarifications at this stage.

✓ Negotiation & Terms: Discuss pricing for your target order quantity. Negotiate politely – Chinese suppliers often expect some haggling, especially for bulk orders. Also negotiate terms:

- Payment: Aim for 30% deposit, 70% on shipment (or even after inspection). Consider Trade Assurance or L/C for safety on a big order.

- Delivery time: Get a commitment on lead time (e.g., “30 days after deposit”).

- Incoterms: FOB is common (you handle freight). If you want them to handle shipping to your port, that’s CIF – get those quotes too to compare.

- Any special requests: e.g., custom packaging, your branding on cartons, inclusion of spare bulbs for lights, etc. Make sure they confirm what’s included and if extra costs apply.

- If exclusivity or IP is relevant (you have a unique design), include that in the contract.

✓ Place Order & Deposit: Once satisfied, confirm the proforma invoice and sales contract. Double-check all details (product photos, codes, descriptions, quantities, unit prices, total amount, delivery date, shipping port). Pay the deposit via the agreed method. Mark the start of production date.

✓ Production Monitoring: Stay in touch during production. It’s okay to ask for an update mid-way. For large orders, you might request a mid-production photo (e.g., “send me a picture when half the goods are made”). This keeps everyone alert that quality matters. Begin coordinating with a freight forwarder now – let them know an order is in progress, the ready date, and estimate / calculate weight/volume to start booking space.

✓ Quality Control (Pre-shipment): Never skip this! When production is nearly done, arrange your inspection:

- If you hired a third-party inspector, schedule it promptly when supplier says goods are ready.

- Or ask for detailed photos of random samples and packaging from the final batch.

- Review inspection results. If issues are found, resolve them (have supplier rework defects, or negotiate a solution).