ChAFTA Certificate of Origin: 0% Tariff on China Imports, How to Apply & Zero-Tariff Rules

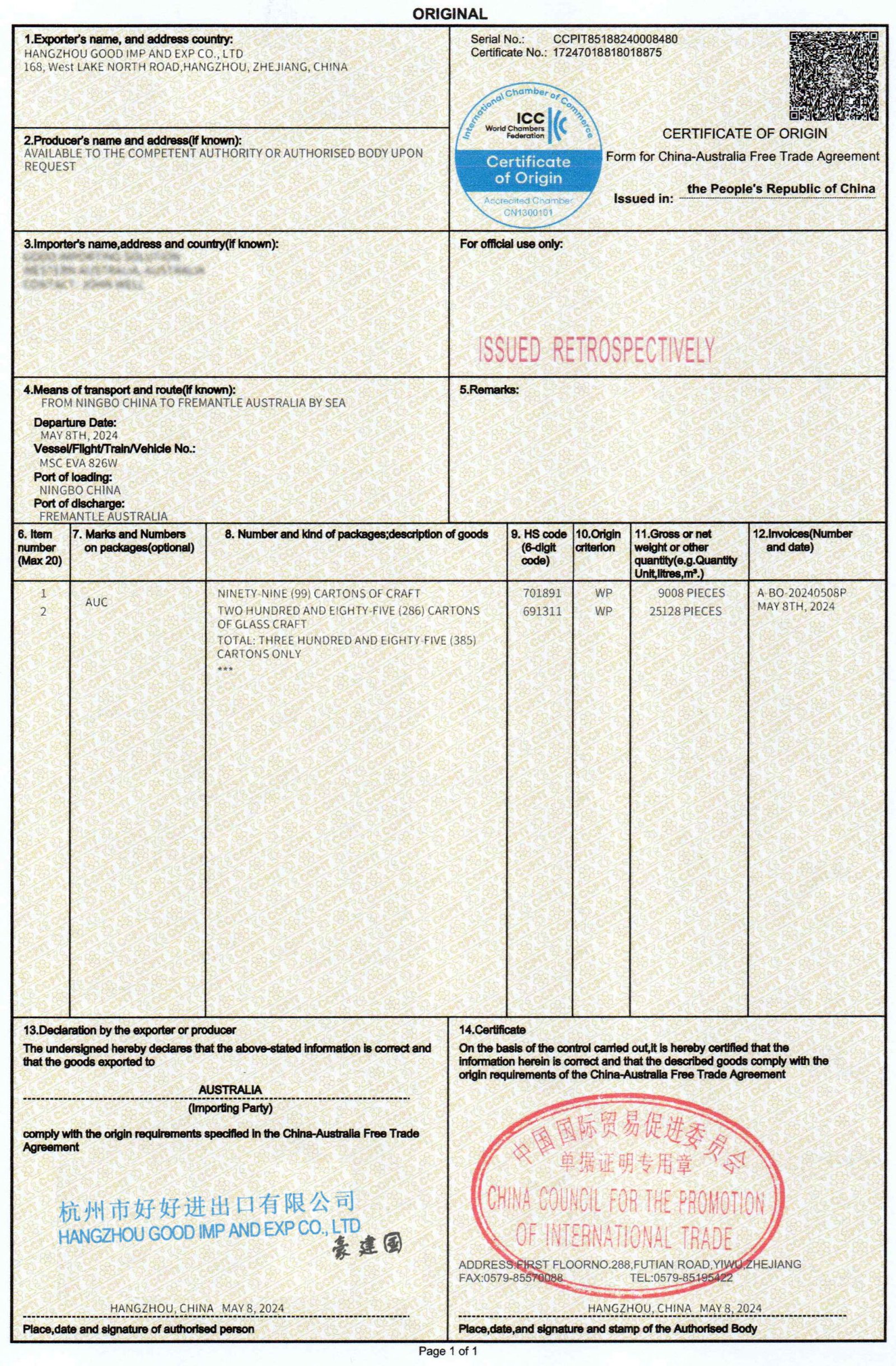

Genuine CCPIT-stamped ChAFTA Certificate of Origin

If you import goods from China into Australia, the China–Australia Free Trade Agreement (ChAFTA) Certificate of Origin – often called the ChAFTA Origin Certificate – is a crucial document.

No CO (Certificate of Origin), no preference—simple as that. This certificate is the key to claiming zero customs duties on your Chinese imports under the China–Australia Free Trade Agreement. Without it, your products could attract import tariffs of up to 5–10% (the normal MFN rate), directly impacting your costs and competitiveness. With the certificate, qualifying goods can clear at preferential (often zero) duty under the China–Australia Free Trade Agreement, delivering significant savings.

In this guide, we explain the tariff benefits of ChAFTA, what the origin certificate is, how to obtain it, and other essential details – providing a clear roadmap for Australian importers and wholesalers to make the most of ChAFTA’s advantages.

What Is a ChAFTA Certificate of Origin?

A ChAFTA Certificate of Origin is an official document that certifies your goods originate from China (or Australia) and therefore qualify for preferential tariff treatment under the China–Australia Free Trade Agreement. In other words, it’s proof that the products meet the FTA’s origin rules, allowing the importer to claim the ChAFTA preferential duty rate (usually 0%) instead of the normal tariff.

Official Name: The certificate’s full title is “Certificate of Origin Form for China-Australia Free Trade Agreement”, often abbreviated simply as “ChAFTA Certificate of Origin.” It is sometimes referred to as a “Form ChAFTA” by customs. The certificate format was established when the CHAFTA came into force and includes a unique certificate number and details about the exporter, importer, goods, and their origin status.

It’s important to understand that the ChAFTA certificate of origin is specific to each shipment. One certificate covers one consignment of goods (it can list multiple items/HS codes on the same shipment, up to 20 product lines) and is valid for up to one year from the date of issue. If you have recurring shipments, a new certificate (or a renewal) is generally needed for each batch unless other arrangements (like a Declaration of Origin by an approved exporter) are in place. Most Australian importers will rely on the exporter in China to provide this certificate for every shipment to ensure preferential tariffs can be claimed.

So, What is China-Australia Free Trade Agreement (ChAFTA)

The China–Australia Free Trade Agreement, commonly known as ChAFTA, is a bilateral trade agreement between the Australian and Chinese governments that eliminates or reduces tariffs on goods traded between the two countries. ChAFTA is a comprehensive free trade agreement covering trade in goods, services, and investment. Officially titled the “Free Trade Agreement between the Government of Australia and the Government of the People’s Republic of China”, ChAFTA was the result of a decade of negotiations (talks began in April 2005) aimed at fostering closer economic ties. The agreement was signed on June 17th 2015 by Australia’s Trade Minister Andrew Robb and China’s Commerce Minister Gao Hucheng in Canberra, and it entered into force on December 20th 2015. At entry into force, 91.6% of originating goods from China received zero duty immediately, with zero tariffs for essentially all Chinese-origin goods after a 5-year transition.

*You can visit the official original documents via below link to Ministry of Commerce of The People’s Republic of China:

https://brisbane.mofcom.gov.cn/Doc/art/2025/art_43c27b37e1a046f0ad191922b2600a62.html

It’s worth noting that while ChAFTA removes customs duties, businesses must still comply with other import requirements (quarantine, standards, etc.), and taxes like GST still apply domestically. However, ChAFTA’s tariff benefits provide a significant boost to profitability for importers – and the Certificate of Origin is the document that unlocks those benefits.

Who issues the ChAFTA CO?

In China, the ChAFTA Certificate of Origin must be issued by an authorized body in order to be valid for claiming FTA benefits. There are two main issuing authorities approved under the agreement:

- The China Council for the Promotion of International Trade (CCPIT) – and its regional branches across China.

- The General Administration of Customs of China (GACC) – via its designated customs offices and electronic platforms.

What documents do you need to apply for CHAFTA CO?

To obtain a ChAFTA origin certificate, the exporter (the Chinese supplier or your agent) needs to prepare these core documents (details must match across all paperwork):

- Bill of Lading (B/L) or Air Waybill (AWB)

- Commercial Invoice (with invoice number, unit price, total price, buyer/seller)

- Packing List

- Export Declaration (to prove the goods were formally exported)

- HS Code (confirmed and aligned with the PSR)

- Consignee/Consignor details (must match across all docs)

Important Tips: Keep descriptions, HS Codes, quantities, date and invoice numbers consistent across the B/L, invoice, packing list, export declaration, and CO application to avoid delays.

Origin Criteria and Rules under ChAFTA

Before we apply for the ChAFTA CO, we must be very clear on Origin Criteria and Rules. Having a certificate is not a mere formality – it must be backed by the fact that the goods qualify as “originating” under ChAFTA. The free trade agreement sets specific rules of origin that determine whether a product is considered to originate from China or Australia (and thus is eligible for preferential tariffs). Here’s an overview of the origin criteria (If you don’t want to read the complex criteria and rules for origin determination below, you don’t need to worry. Based on my nearly 16 years of experience, 95% to 99% of China’s exports to Australia can obtain the China-Australia Free Trade Agreement Certificate of Origin. Therefore, you can treat the following criteria as knowledge to deepen your understanding of the certificate of origin.):

- Wholly Obtained or Produced Goods: If a product is entirely produced or obtained in one country (China or Australia) with no foreign inputs, it is automatically considered originating. This covers natural products and raw materials. For example, minerals extracted in China, crops grown and harvested in China, live animals born and raised in China, or goods made entirely from such local inputs all fall under this category. (Similarly, wholly obtained Australian goods qualify when exporting to China.) These are straightforward cases – e.g. Australian wool or Chinese iron ore need no further calculation to qualify.

- Goods Made Exclusively from Originating Materials: If a finished product is manufactured in China using only materials that themselves are originating (from China or Australia), then that product is also treated as originating. For instance, imagine a Chinese factory produces clothing using Australian cotton fabric and Chinese thread; if both the fabric and thread are originating under the FTA (Australian cotton is originating, and the thread made in China from Australian cotton is also originating), then the final garment is considered originating. In practice, this rule means if all components of your product are from Australia/China, the product qualifies.

- Goods with Non-Originating Materials (Substantial Transformation): This is the most common scenario for manufactured goods – products made in China that include some imported materials. Such goods can still qualify as originating if they undergo sufficient processing in China to meet the Product-Specific Rules (PSR) outlined in ChAFTA. Each category of products (defined by HS code) has specific criteria in Annex II of the agreement. The criteria could be a Change in Tariff Classification (e.g. the final product’s HS code is different from all the imported inputs’ codes, indicating a substantial transformation) or a Regional Value Content (RVC) threshold (e.g. at least 40% of the product’s value is added in China/Australia), or sometimes a combination of both. In simpler terms, if China has significantly transformed the inputs from other countries – such as assembling, processing, or manufacturing them into a new product – the good may qualify under ChAFTA’s origin rules. If the foreign inputs are not sufficiently transformed (for example, just minor processing or repackaging), the good would not qualify. The certificate of origin will indicate the origin criterion used (often a code like “WO” for wholly obtained or “PSR” for product-specific rule).

For example, consider an electronic appliance assembled in China using components from various countries. Under ChAFTA’s rules, this appliance could qualify for a ChAFTA certificate if, say, the assembly process changes the tariff classification (meaning the finished appliance falls under a different HS code than its parts) or the Chinese content meets the required percentage of value. On the other hand, if a Chinese company simply imports a fully finished product from a third country and re-exports it to Australia with minimal change, it would not meet the origin criteria and would not be eligible for the ChAFTA certificate (even if a document were mistakenly issued, Australian Customs would not accept it if the goods don’t truly qualify).

How to Apply for the CHAFTA Certificate of Origin (Step-by-Step)?

- Log in to China International Trade “Single Window”(https://www.singlewindow.cn/)→ Customs → Certificates of Origin → Certificate Application, or use the “Internet + Customs” online service (an integrated web platform for customs procedures) portal → Tax & Fees → Origin Certificate Management → Certificate Issuance.

- Choose “ChAFTA Certificate of Origin” and complete the application form.

- Double-check consistency with your B/L, invoice (especially the invoice number and date), and packing list.

- Submit and follow up if the issuing office requests clarification.

- Issuance of the Certificate: After approval, the certificate of origin is issued. If it’s electronic, the exporter can download the e-certificate (usually a PDF with digital seals/signatures). If a paper certificate is needed, the exporter can print it (or pick up a printed/stamped copy from customs or CCPIT). Each certificate will have a unique serial number, an official stamp (for paper forms, an ink stamp from Customs or CCPIT; for electronic, a digital seal), and the signature of the issuing officer (or a digital equivalent). The certificate will indicate the place and date of issue, and the issuing authority (e.g., “Customs District of Yiwu” or “CCPIT Yiwu Sub-Council”).

When applying online, the exporter fills in all required details and submits the application electronically. After review, the certificate is issued either in electronic form or as a paper certificate with an official stamp from the issuing authority. CCPIT also offers services to issue certificates – in some cases, exporters might apply through CCPIT offices, which then provide a stamped paper certificate. But increasingly, electronic certificates are used and are acceptable to Australian Customs as long as they are issued by GACC or CCPIT. Each certificate will have a unique number and an official seal or digital signature from the issuer, ensuring its authenticity.

For importers, it’s good to know which body issued the certificate (it will be indicated on the document). Both GACC-issued and CCPIT-issued certificates are valid for claiming ChAFTA tariff preferences. If there’s ever any doubt about a certificate’s legitimacy, Australian Border Force can verify it through their channels (in fact, Australia and China have systems in place for electronic exchange/verification of certificates). As an Australian importer, you typically don’t need to navigate the Chinese application process yourself – your supplier or your agent will handle the application – but being aware of how it works will help you communicate with your supplier and ensure you receive the correct documentation.

How to Fill in the CHAFTA Certificate Form: The Ultimate Detailed Guide

I will share a detailed example, explaining the requirements and rules for each, cell by cell. See below:

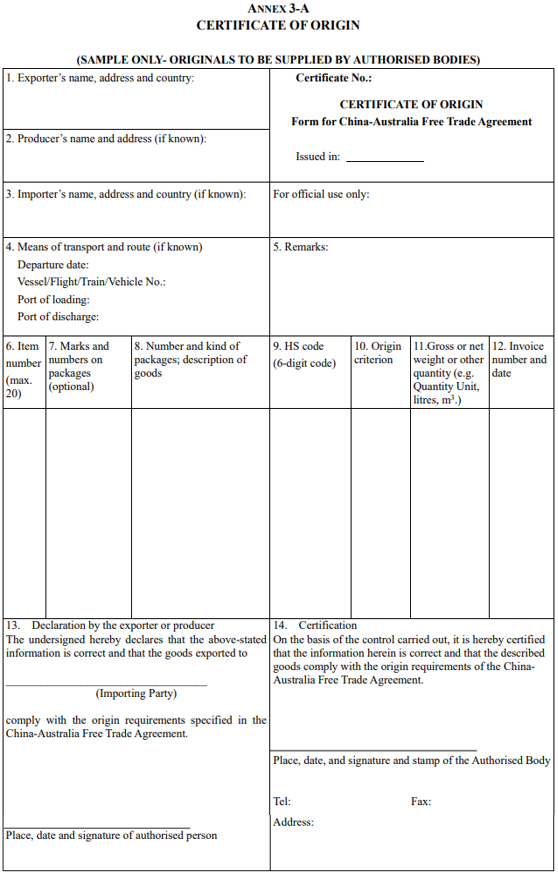

Official Certificate of Origin blank form template for China-Australia Free Trade Agreement (ChAFTA). Download blank CO form for export documentation and customs clearance reference.

CHAFTA Certificate Form Fill-in Instruction

Box 1: State the full legal name and address of the exporter in Australia or China.

Box 2: State the full legal name and address (including country) of the producer, if known. If more than one producer’s good is included in the certificate, list the additional producers, including names and addresses (including country). If the exporter or the producer wish the information to be confidential, it is acceptable to state“Available to the competent authority or authorised body upon request”. If the producer and the exporter are the same, please complete the box with “SAME”. If the producer is unknown, it is acceptable to state “UNKNOWN”.

Box 3: State the full legal name and address of the importer in Australia or China, if known.

Box 4: Complete the means of transport and route and specify the departure date, transport vehicle number, and port of loading and discharge, if known.

Box 5: The Customer’s Order Number, Letter of Credit Number, among others, may be included. If the invoice is issued by a non-Party operator, information such as the name, address and country of the operator issuing the invoice shall be indicated herein.

Box 6: State the item number; item number shall not exceed 20.

Box 7: State the shipping marks and numbers on packages, when such marks and numbers exist.

Box 8: The number and kind of packages shall be specified. Provide a full description of each good. The description should be sufficiently detailed to enable the products to be identified by the Customs Officers examining them and relate it to the invoice description and to the HS description of the good. If the goods are not packed, state

“in bulk”. When the description of the goods is finished, add “***” (three stars) or “ \ ” (finishing slash).

Box 9: For each good described in Box 8, identify the HS tariff classification (a six-digit code).

Box 10: For each good described in Box 8, state which criterion is applicable, according to the following instructions.

The rules of origin are contained in Chapter 3 (Rules of Origin and Implementation Procedures) and Annex II

(Product Specific Rules of Origin) of the China-Australia Free Trade Agreement.

| Origin Criterion | Insert in Box 10 |

|---|---|

| The good is “wholly obtained” in the territory of a Party in accordance with Article 3.3 (Wholly Obtained Goods). | WO |

| The good is produced entirely in the territory of one or both Parties, exclusively from materials whose origin conforms to the provisions of Chapter 3 (Rules of Origin and Implementation Procedures). | WP |

| The good is produced in the territory of one or both Parties, using non-originating materials that comply with the applicable product specific rule; and meets the other applicable provisions of Chapter 3 (Rules of Origin and Implementation Procedures). | PSR |

Box 11: State gross or net weight in kilograms or other units of measurement for each good described in Box 8. Other units of measurement (e.g. volume or number of items) which would indicate exact quantities may be used where customary.

Box 12: The invoice number and date should be shown here.

Box 13: The box must be completed by the exporter or producer. Insert the place, date and the signature of a person authorised by the exporter or producer.

Box 14: The box must be completed, signed, dated and stamped by the authorised person of the authorised body. The telephone number, fax and address of the authorised body should be given.

How much does a Certificate of Origin under the China–Australia Free Trade Agreement (ChAFTA) cost per certificate?

Typically, using an agent to obtain a Certificate of Origin typically costs RMB 100–200 (AU$ 22.22 – AU$44.45) per certificate.

First, please note that the issuing authorities—such as China Customs and the China Council for the Promotion of International Trade (CCPIT)—do not charge the fees for issuing the certificate itself.

Agency fees mainly cover the company’s share of software licensing and annual service charges (approximately 10%–20% of the total), as well as labor / handling costs and courier expenses for delivering the physical original certificate.

Good practice & common pitfalls (learned the hard way)

- Match everything: invoice number, quantities, weights, consignee name and address must be identical across the certificate, invoice, packing list, and transport doc.

- Describe clearly: use commercial descriptions that align with the HS code and PSR.

- Check PSR early: confirm CTC/RVC feasibility before production, especially for assemblies with imported components.

- Mind the dates: ensure the certificate issue date works for your shipment and clearance timeline.

- Keep records: retain BOMs, supplier declarations, and costing sheets to substantiate origin if audited.

- One shipment, one CO: avoid mixing unrelated consignments on a single certificate.

- Prefer e-CO when available: faster transmission, fewer courier delays.

MFN (Most Favored Nation Treatment) vs CHAFTA Rate — Quick Recap

- MFN (Most-Favored-Nation) is the baseline tariff Australia applies to WTO members when no FTA preference is claimed. Think of it as the default setting.

- CHAFTA preferential rate applies only if your goods meet the Rules of Origin and you present a valid CHAFTA Certificate of Origin.

- Why it matters: If your HS code carries an MFN of 5%, CHAFTA can drop that to 0% for qualifying goods—direct savings on day one.

- Pro tip: Align HS code and PSR before production, and make the CO part of your standard document pack to avoid missing the preference at clearance.

Frequently Asked Questions

Q1: Do samples or low-value courier shipments need a CHAFTA Certificate?

A: If treated as commercial imports, the buyer can still benefit from preferences if origin is proven. For personal low-value shipments (≤ AUD 1,000 CIF), duty may be waived anyway, but GST typically applies.

Q2: Is duty always zero with ChAFTA?

A: If your goods are originating and you present a valid ChAFTA CO, the preferential duty rate is zero for covered items. Non-originating goods or shipments without a CO pay the normal tariff (up to 10%).

Q3: How long does it take to get the CHAFTA CO?

A: Usually 1–2 business days after you submit correct documents. Many exporters apply for the certificate right after the goods have been shipped (once they have the final Bill of Lading and other documents). In urgent cases, the certificate can sometimes be issued within one working day. If your shipment is already on the way, rest assured that the certificate will likely be ready before the goods arrive in Australia, as long as your supplier applies promptly. (It’s a good idea to remind your supplier to apply for the CO as soon as the goods depart, if not earlier.)

Q4: What is Validity Period of CHAFTA Certificate Origin?

A: A ChAFTA Certificate of Origin is valid for one year from its date of issuance.

This means the importer can claim the preferential tariff as long as the goods are entered into Australian customs within 12 months of the certificate’s issue date. For example, if a certificate was issued on January 1, 2025, it can be used for an import declaration up to December 31, 2025 for the goods listed. After one year, the certificate expires and cannot be used to claim preferences (though in practice, it’s rare to use an old certificate because it’s tied to a specific shipment that would normally arrive soon after export). If an import is delayed and you worry the certificate might “expire” by the time of clearance, you should seek advice – typically, if goods land after the certificate validity, customs might require a new certificate or other proof.

Keep in mind that each certificate is meant for a single shipment/consignment. You cannot reuse a certificate for a different shipment, even if within the one-year validity. The one-year validity more so allows some flexibility if there’s a customs entry adjustment or a post-import claim.

Q5: Can I apply the certificate after shipment?

A: Yes, post-export issuance is possible. Coordinate with the buyer’s broker so the document is available in time for duty preference at clearance or for a post-entry refund where allowed.

Q6: Who can issue the CHAFTA CO in China?

A: The China Council for the Promotion of International Trade (CCPIT) (CCPIT) and China Customs (GACC).

Q7: What if my shipment value is under AUD 1,000?

A: For personal low-value goods (≤ AUD 1,000 CIF), duty may be exempt but GST still applies. Commercial imports are dutiable regardless of value.

If you need any help or assistance on CHAFTA Certificate of Origin or buying from China, you are welcome to contact us at anytime.

Contact Information as below:

Email:kevin@china-buying-support.com

Phone | WhatsApp:+86 1860 5899 103

Thank you.

Joining Us With 1,200+ Happy Clients Enjoying Buying From China now!

Becoming One of China-Buying-Support family to Get a Easier and Trouble-Free Sourcing and Shipping Service.